Monitoring cryptocurrency

Bitcoin has enjoyed a meteoric rise to prominence since its 2009 inception. It’s the most widely used open-source peer-to-peer cryptocurrency that you can send over the Internet without a bank or a middleman. Bitcoin is a public ledger (called block chain), kept by every node in the network. One’s balance is whatever the ledger says. Transactions are irreversible, fast and have low fees. Everyone who uses bitcoin is a tiny fraction of the bank of bitcoin. Nobody owns or controls this system.

However, it looks like New York’s financial district is the place to be for would-be bitcoin speculators. The New York Stock Exchange (NYSE) is going to start monitoring bitcoin value. Essentially, bitcoin will look and feel like any other foreign currency market on the NYSE’s ticker.

The NYSE Bitcoin Index (NYBXT) will keep a beady eye on how much the cryptocurrency is worth, relative to the US dollar, with the data being pulled from Coinbase (and what’s noteworthy is that NYSE made a small investment in the business earlier this year). That way, investment types can get a quick read on how bitcoin is doing at any one time, with the value being updated at 11:00 AM ET each day.

Bitcoin’s march toward legitimacy

It all started with hardcore computer experts making as a serious attempt to change the economic and political landscape and it quickly attracted a core group of libertarians and cryptography enthusiasts. Bitcoin is recognized as the first cryptocurrency – digital currency that uses cryptography for security. It may as well be called cryptic currency because it’s nowhere near as easy to figure out as typical money, but here’s a decent attempt:

They (yes they – there are over 650 different Crypto Coins in existence; Dogecoin, Litecoin and Quarkcoin for instance) do represent money in digital form, but using them is a bit more complicated than digital payment services like, say PayPal. Also, unlike banks and online services, they’re decentralized with no single governing body overseeing and verifying transactions. Since no institutions regulate cryptocurrencies, there’s no bank that would print more money when the need arises (but here’s a website that sells actual physical bitcoins with your address and private key hidden underneath a hologram).

The supply of bitcoins is regulated by software and the agreement of users of the system and can’t be manipulated by any government, bank, organization or individual. Even though no name or email address is associated with an account, the system’s not entirely anonymous, though.

Going mainstream?

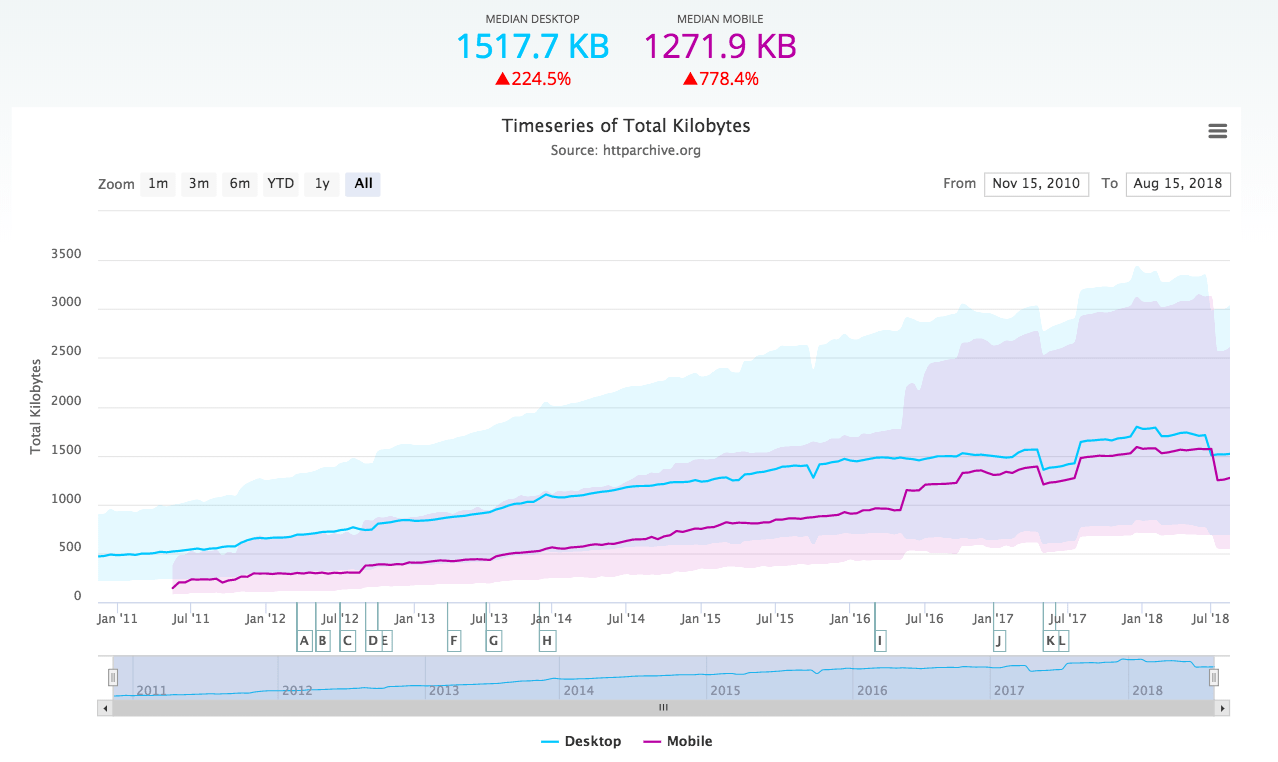

The values of cryptocurrencies fluctuate quickly and widely. Why has bitcoin suddenly risen to prominence? The disruptive new economy? Anyway, the warm hand of government regulations may be enough to take bitcoin into the mainstream. Whether or not governments sanction the use of bitcoin is now almost irrelevant to its prevalence in international markets on a worldwide scale. The dilemma that bitcoin is facing is how to change its core software so that the growing volume of transactions doesn’t overwhelm the network.

The NYSE says that its Index Committee will oversee the rules and methodology behind this project and it will be responsible for ensuring the accuracy and reflection of “the current nature of the evolving bitcoin market.”

Support the development

Do you want to know more or participate in the bitcoin project? Check out the Bitcoin Foundation – a non profit organization that provides funding for development and infrastructure for bitcoin.