Lately, the web has been abuzz with Instagram’s billion-dollar sale to Facebook. This is an enormous amount of money for a service that is less than two years old. Instagold, so to speak.

Lately, the web has been abuzz with Instagram’s billion-dollar sale to Facebook. This is an enormous amount of money for a service that is less than two years old. Instagold, so to speak.

This made us think. As you know, there have been a fair amount of high-profile deals like this ever since the initial dot-com boom back around 1998-1999. When it comes to time invested versus the sales price, how well does the Instagram acquisition stack up? It should be pretty high up there, but let’s compare it with a number of other tech acquisitions to get some facts on the table.

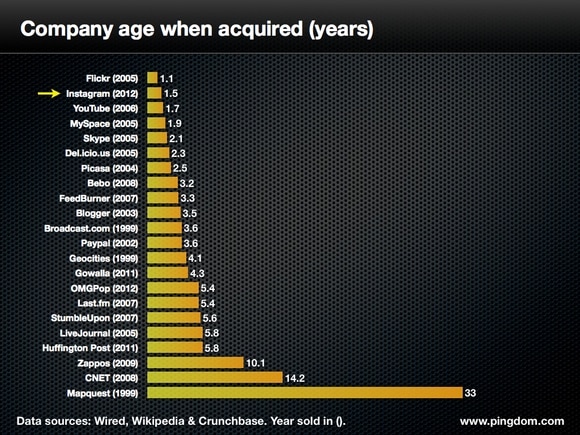

Company age when acquired

First of all, startups being scooped up quickly by big players is nothing new. YouTube had been around less than two years when Google bought it in 2006, and Skype wasn’t much older when eBay bought it in 2005. Another quick sale was MySpace.

There have also been even faster acquisitions than Instagram’s: Yahoo bought Flickr when the service was barely a year old (although Flickr reportedly got a “mere” $30 million).

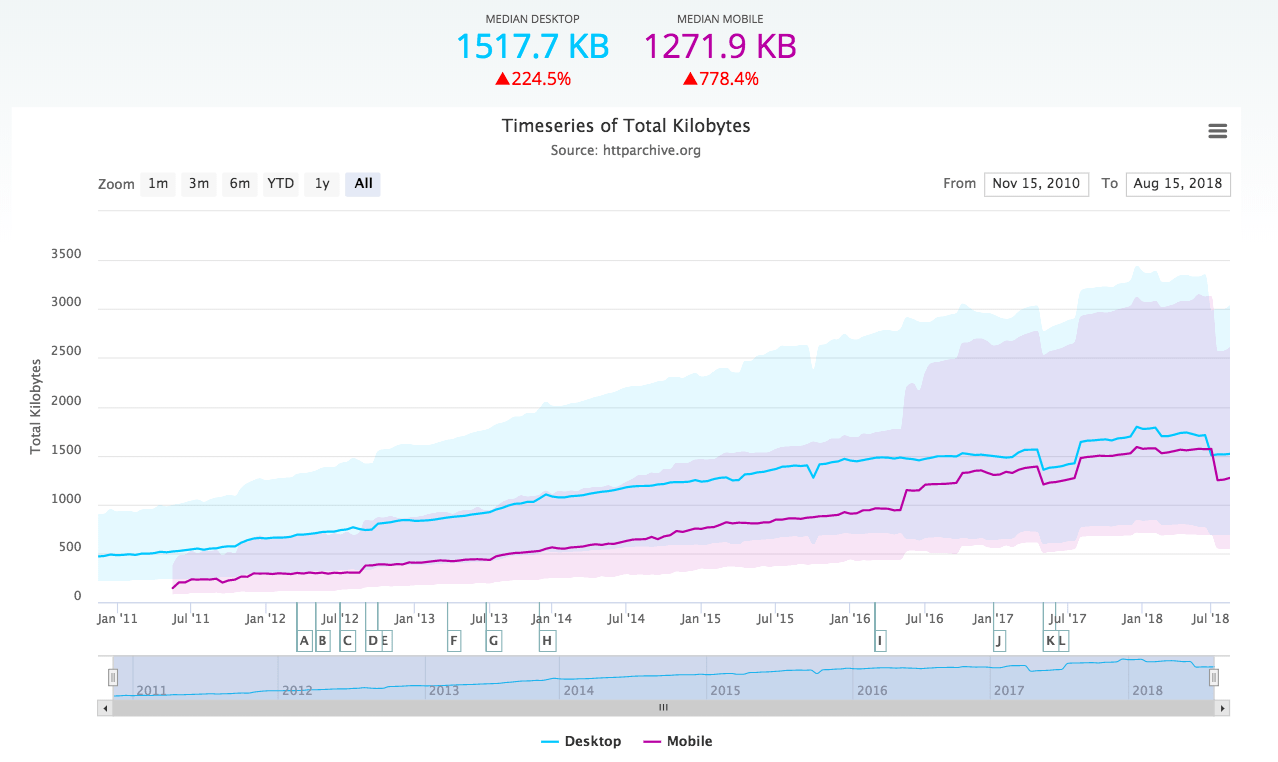

Here is a chart showing the age of various tech companies and services when they were bought. Note that this is in no way a complete list.

(Some of these have been sold more than once, like Skype, but we only include the first sale here.)

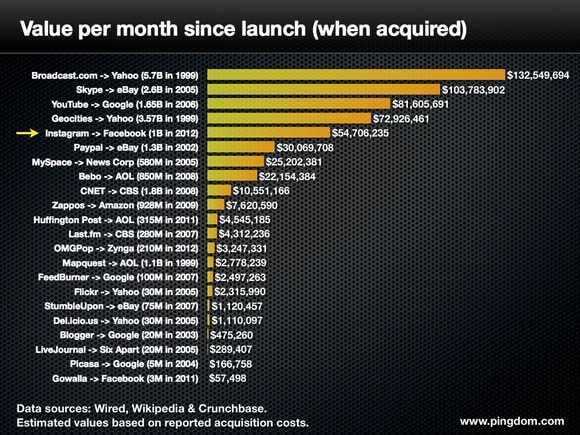

Now let’s put the acquisition price into this equation. Cost divided by time the company had been around when it was bought.

Cost per month of operation when sold

How valuable was the time invested in these companies when they were sold? How does the Instagram-Facebook deal compare to the other deals we’ve included here? Time to find out:

Of the companies we included here, Instagram does well, but it isn’t at the top. Still, a $54+ million return per month of operation is pretty astonishing.

Worth noting is that we’re simply looking at the quickest, biggest payoffs for companies here. We’re using the age of the company, which is not really the equal to the overall time invested. That would be man years if we were being totally accurate. Something to keep in mind, considering the Instagram team is so small.

In other words, if we had counted “value per man year invested,” Instagram may very well have topped this list.

Other interesting metrics

There are many ways of looking at a sale like the Instagram-Facebook deal. We would like to recommend an excellent article by Andy Baio over at Wired’s Epicenter blog, which puts the Instagram acquisition in context with cost-per-employee and cost-per-user charts. Check it out if you haven’t already. We actually used his list of high-profile acquisitions as a data source for much of this article.

What’s pretty amazing about the Instagram sale, in our opinion, is that many of the other companies on this list had hundreds of employees when they sold. Instagram had 13. As others have pointed out, that billion-dollar price point is the equivalent of $77 million per employee.